Nebraska Sales Tax By County . Use our calculator to determine your exact sales tax rate. Nebraska sales tax statistics by county and by business classification. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Nebraska has a statewide sales tax of 5.5%. Current local sales and use tax rates and other sales and use tax information Nebraska sales tax rates by city and county. On the nebraska department of revenue website. Nebraska jurisdictions with local sales and use tax. Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax. These tables show an analysis by county and business classification. Verifying current local sales and use tax rates by county or municipality. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,. Municipal governments in nebraska are.

from www.formsbank.com

Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax. Municipal governments in nebraska are. Nebraska sales tax rates by city and county. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Verifying current local sales and use tax rates by county or municipality. Nebraska has a statewide sales tax of 5.5%. Nebraska sales tax statistics by county and by business classification. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,. Use our calculator to determine your exact sales tax rate. These tables show an analysis by county and business classification.

Top 26 Nebraska Sales Tax Form Templates free to download in PDF format

Nebraska Sales Tax By County Nebraska sales tax rates by city and county. Nebraska sales tax statistics by county and by business classification. Verifying current local sales and use tax rates by county or municipality. Current local sales and use tax rates and other sales and use tax information Nebraska sales tax rates by city and county. Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax. On the nebraska department of revenue website. These tables show an analysis by county and business classification. Use our calculator to determine your exact sales tax rate. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Municipal governments in nebraska are. Nebraska has a statewide sales tax of 5.5%. Nebraska jurisdictions with local sales and use tax. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,.

From www.formsbank.com

Top 26 Nebraska Sales Tax Form Templates free to download in PDF format Nebraska Sales Tax By County Nebraska sales tax statistics by county and by business classification. On the nebraska department of revenue website. Verifying current local sales and use tax rates by county or municipality. Municipal governments in nebraska are. Nebraska sales tax rates by city and county. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in. Nebraska Sales Tax By County.

From www.formsbank.com

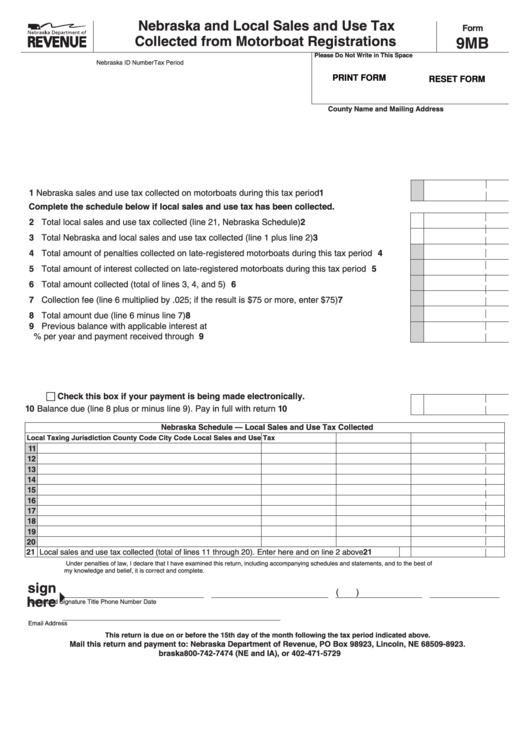

Form 10 Nebraska And Local Sales And Use Tax Return printable pdf Nebraska Sales Tax By County Nebraska sales tax statistics by county and by business classification. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Verifying current local sales and use tax rates by county or municipality. On the nebraska department of revenue website. Nebraska sales tax rates by city and county. Nebraska has 149 cities, counties, and special. Nebraska Sales Tax By County.

From www.formsbank.com

Form 10 Nebraska Schedule I Local Sales And Use Tax 2000 Nebraska Sales Tax By County On the nebraska department of revenue website. Use our calculator to determine your exact sales tax rate. Nebraska sales tax statistics by county and by business classification. Current local sales and use tax rates and other sales and use tax information Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska. Nebraska Sales Tax By County.

From nebraskapublicmedia.org

Nebraska to require more online retailers collect sales tax Nebraska Nebraska Sales Tax By County Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Nebraska sales tax rates by city and county. Current local sales and use tax rates and other sales and use tax information Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax.. Nebraska Sales Tax By County.

From www.dochub.com

Nebraska sales tax form 10 Fill out & sign online DocHub Nebraska Sales Tax By County On the nebraska department of revenue website. Verifying current local sales and use tax rates by county or municipality. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Nebraska has a statewide sales tax of 5.5%. Nebraska sales tax statistics by county and by business classification. Current local sales and use tax rates. Nebraska Sales Tax By County.

From www.formsbank.com

Notice To Nebraska And Local Sales And Use Tax Permitholders printable Nebraska Sales Tax By County On the nebraska department of revenue website. Nebraska has a statewide sales tax of 5.5%. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Current local sales and use tax rates and other sales and use tax information Use our calculator to determine your exact sales tax rate. Nebraska jurisdictions with local sales. Nebraska Sales Tax By County.

From www.youtube.com

Nebraska Tax Sales Tax Liens YouTube Nebraska Sales Tax By County Municipal governments in nebraska are. Nebraska sales tax rates by city and county. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,. Verifying current local sales and use tax rates by county or municipality. On the nebraska department of revenue website. Nebraska has. Nebraska Sales Tax By County.

From propertytaxrate.blogspot.com

Nebraska Sales Tax Rate Finder Nebraska Sales Tax By County 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,. Nebraska jurisdictions with local sales and use tax. Nebraska sales tax rates by city and county. Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the. Nebraska Sales Tax By County.

From www.dochub.com

Nebraska sales tax exemption chart Fill out & sign online DocHub Nebraska Sales Tax By County Current local sales and use tax rates and other sales and use tax information Nebraska jurisdictions with local sales and use tax. Municipal governments in nebraska are. Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax. Nebraska sales and use tax rates in 2024 range from 5.5%. Nebraska Sales Tax By County.

From www.openskypolicy.org

“Real Taxpayers of Nebraska” and increasing the property tax credit Nebraska Sales Tax By County Nebraska sales tax statistics by county and by business classification. Nebraska jurisdictions with local sales and use tax. Verifying current local sales and use tax rates by county or municipality. Current local sales and use tax rates and other sales and use tax information These tables show an analysis by county and business classification. Nebraska sales tax rates by city. Nebraska Sales Tax By County.

From taxfoundation.org

State Individual Tax Rates and Brackets Tax Foundation Nebraska Sales Tax By County Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax. Use our calculator to determine your exact sales tax rate. Municipal governments in nebraska are. Nebraska jurisdictions with local sales and use. Nebraska Sales Tax By County.

From formspal.com

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online Nebraska Sales Tax By County Nebraska sales tax statistics by county and by business classification. Nebraska has 149 cities, counties, and special districts that collect a local sales tax in addition to the nebraska state sales tax. Verifying current local sales and use tax rates by county or municipality. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is. Nebraska Sales Tax By County.

From 1stopvat.com

Nebraska Sales Tax Sales Tax Nebraska NE Sales Tax Rate Nebraska Sales Tax By County 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,. Municipal governments in nebraska are. On the nebraska department of revenue website. Nebraska jurisdictions with local sales and use tax. Use our calculator to determine your exact sales tax rate. Nebraska has a statewide. Nebraska Sales Tax By County.

From formspal.com

Nebraska Sales Tax Statement PDF Form FormsPal Nebraska Sales Tax By County 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in the cities of grand island, papillion, north platte,. Verifying current local sales and use tax rates by county or municipality. Municipal governments in nebraska are. On the nebraska department of revenue website. Use our calculator to determine your exact sales tax rate.. Nebraska Sales Tax By County.

From webinarcare.com

How to Get Nebraska Sales Tax Permit A Comprehensive Guide Nebraska Sales Tax By County Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Nebraska sales tax statistics by county and by business classification. Nebraska sales tax rates by city and county. Nebraska has a statewide sales tax of 5.5%. 534 rows combined with the state sales tax, the highest sales tax rate in nebraska is 7.5% in. Nebraska Sales Tax By County.

From formspal.com

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online Nebraska Sales Tax By County Use our calculator to determine your exact sales tax rate. Nebraska sales tax statistics by county and by business classification. Verifying current local sales and use tax rates by county or municipality. On the nebraska department of revenue website. Current local sales and use tax rates and other sales and use tax information Municipal governments in nebraska are. Nebraska has. Nebraska Sales Tax By County.

From www.salestaxhelper.com

Nebraska Sales Tax Guide for Businesses Nebraska Sales Tax By County Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. Verifying current local sales and use tax rates by county or municipality. These tables show an analysis by county and business classification. On the nebraska department of revenue website. Municipal governments in nebraska are. Use our calculator to determine your exact sales tax rate.. Nebraska Sales Tax By County.

From ar.inspiredpencil.com

Sales Tax By State Chart Nebraska Sales Tax By County Nebraska has a statewide sales tax of 5.5%. On the nebraska department of revenue website. Current local sales and use tax rates and other sales and use tax information Use our calculator to determine your exact sales tax rate. Municipal governments in nebraska are. Nebraska sales tax statistics by county and by business classification. Nebraska has 149 cities, counties, and. Nebraska Sales Tax By County.